State of Digital Pathology Today – Part 1

Ladies and gentlemen, the state of digital pathology today is strong and will get stronger due to external market forces within the life sciences and healthcare today. This is the first part of several posts to follow on the state of digital pathology today. But in order to see where we are going we need to see where we were, how we got here, what went right, wrong, sideways and look back for some common reference and talking points.

Part 1 – The Promise of Digital Pathology and Market Valuation

This will mark the 16th year I have been involved with digital imaging and pathology informatics in a couple of practice settings beginning with static telepathology to date with whole slide imaging, real-time viewing, cloud computing, image analysis and more.

Until about 14 months ago though there was not a “killer app” for digital pathology. There was difficulty for the market to define a big enough problem to solve with the wide range of technologies, hardware, software, middleware, communications applications, storage, archiving and viewing.

For most clinical laboratories at least, most of us practice within a few yards of our histology laboratories and the need for high-volume, high-throughput scanning with added scanning, storage and viewing costs was not solving a problem or saving money or creating efficiency but rather would create additional layers of processing, time and expense and adoption was slow. Add to that regulatory issues, a recession and declining reimbursements after that and selling to laboratories without a strong business case proved to be a challenge.

If you go back to August of 2008, General Electric announced on business television that they saw digital pathology as a $2 billion dollar market in “several years” with the “pitch” coming from cost savings through increased productivity and efficiencies, perhaps as high as 15% or more “pathology”. These news stories also highlight the interests of multi-hospital systems and those with interests overseas/emerging markets to provide pathology services with added efficiencies and delivery of services. See the two videos below.

If you go back to August of 2008, General Electric announced on business television that they saw digital pathology as a $2 billion dollar market in “several years” with the “pitch” coming from cost savings through increased productivity and efficiencies, perhaps as high as 15% or more “pathology”. These news stories also highlight the interests of multi-hospital systems and those with interests overseas/emerging markets to provide pathology services with added efficiencies and delivery of services. See the two videos below.

Prior to these interviews, I heard figures estimating the digital pathology market being valued as high as $4 billion dollars.

To understand how these valuations were derived, the models were based on number of laboratories, pathologists, cases, blocks, slides, stains, reviews, primary reads and secondary consults, largely within the United States with some business models derived from pathology services insourced from overseas.

Thousands of hospitals, histology laboratories, pathologists by the thousands, cases by the millions and billions and billions of slides. Outside of the revenue streams for professional component, nearly all the models, I think, assumed or predicted that there would be a buck or two a slide that would be “billable, collectable or payable” to/from companies providing hardware, software or communications platforms as a fee-for-service from pathologists/laboratories. Like chemistry or hematology or immunohistochemistry devices, one pays per test for the technology, reagents, labels, service, support, equipment rental, etc…A lab charges $5.00 for a complete blood count which costs $0.50 including phlebotomy and processing. A $88 immunohistochemical stain might cost $42 to do the test and laboratory overhead.

Unlike these tests however, the cost of producing a slide prior to slightly more than a decade ago never took into account the time/cost/expense of scanning and storing a slide payable to the companies providing those technologies. It was never a fixed cost or expense on a spreadsheet. There was no line item for “Digital Pathology” when calculating cost per test for an H&E slide to determine margins and profitability. And no one was going to produce an H&E slide for $5 or 50 cents and add $1 to that without additional reimbursement without a compelling reason to do so or other tangibles or intangibles (research, teaching, interesting cases, image analysis, etc…).

Unlike these tests however, the cost of producing a slide prior to slightly more than a decade ago never took into account the time/cost/expense of scanning and storing a slide payable to the companies providing those technologies. It was never a fixed cost or expense on a spreadsheet. There was no line item for “Digital Pathology” when calculating cost per test for an H&E slide to determine margins and profitability. And no one was going to produce an H&E slide for $5 or 50 cents and add $1 to that without additional reimbursement without a compelling reason to do so or other tangibles or intangibles (research, teaching, interesting cases, image analysis, etc…).

Nonetheless, at a buck a slide times millions of cases and billions of slides, with “full adoption” gets you to a billion-dollar market.

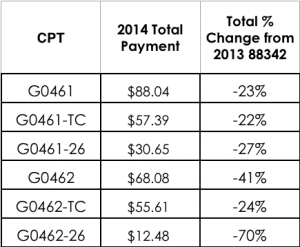

In part 2 I will review true market valuation and why the recent cuts to the biopsy billing code and the death of the immunohistochemistry billing code will necessitate the need for digital pathology.