Develop, Partner, Acquire or Avoid – Where’s Investment for Digital Pathology Headed?

Imogen Fitt of Signify Research attended the 9th Digital Pathology and AI Congress: Europe in December. In the article below she shares her thoughts on the conference with respect to recent industry discourse.

Imogen Fitt of Signify Research attended the 9th Digital Pathology and AI Congress: Europe in December. In the article below she shares her thoughts on the conference with respect to recent industry discourse.

News of Fujifilm’s recent acquisition of software provider Inspirata’s digital pathology assets was met with much interest last month, following on from robust industry debate at Global Engage’s Digital Pathology and AI Congress: Europe a few weeks prior. There discussions centred around the progress of the market and its inevitable future developments.

Whilst our in-depth analysis on the implications of Fujifilm’s specific deal will be released soon as a part of our Premium Insights service, below we outline the wider investment landscape and our own views on what the future holds below.

Whilst VC Investment has Dwindled, the Market Opportunity Remains Ripe

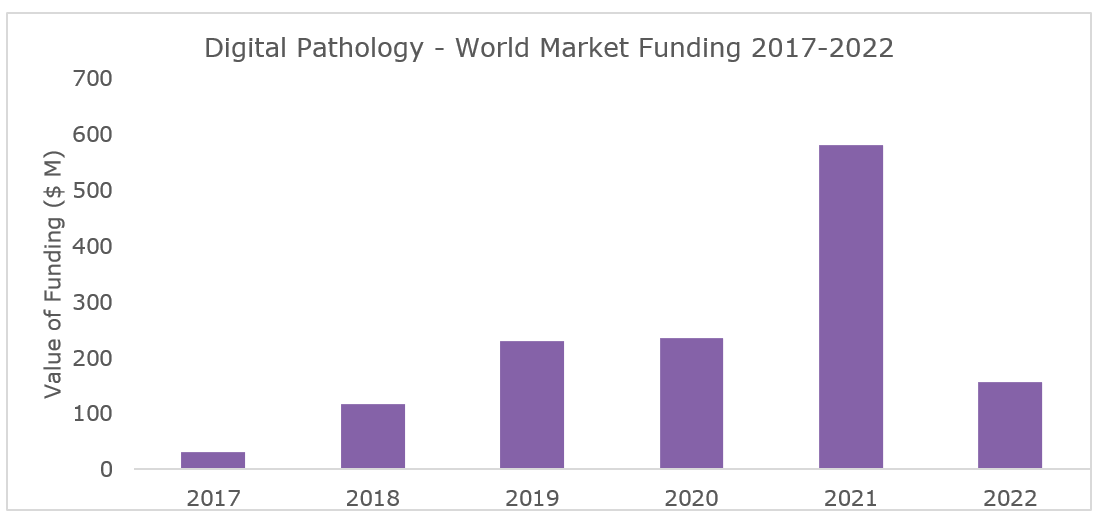

Our initial analysis of the digital pathology VC investment landscape, released in 2021, noted that although investment had spiked in 2021, see Figure 1, it was likely that this would not continue into 2022.

Figure 1: Summary of Digital Pathology VC Investment from 2017-2022.

Figure 1: Summary of Digital Pathology VC Investment from 2017-2022.

Certainly, investment in the market has slowed since, as there has been no funding recently raised that’s comparable to PathAI or Paige.ai’s 2021 rounds, which both received over $100M respectively. Vendors at the time profited due to a post-COVID hype and sky-high valuations; since, VC firms have taken a more sober approach. Lack of VC investment, however, does not mean that the market is not progressing.

Investment is Evident in Other Ways

Over the last year vendors have reported encouraging market growth and we have seen an increase in deal sizes for digital pathology. This growth in demand has also been supported by institutions and regulatory authorities, with the most prominent example coming in September 2022 when the FDA announced it would be creating 13 new add-on digital pathology codes, though admittedly only a first foray via the Category III CPT coding mechanism.

Another seal of approval was also awarded by leading healthcare technology vendors, when Siemens Healthineers, and GE Healthcare, both multi-billion-dollar companies, partnered with digital pathology software providers Proscia and Tribun Health respectively.

These positive movements, combined with the three significant investments over the course of a single year, left many wondering if a flurry of acquisitions would follow?

Prospective Purchasers

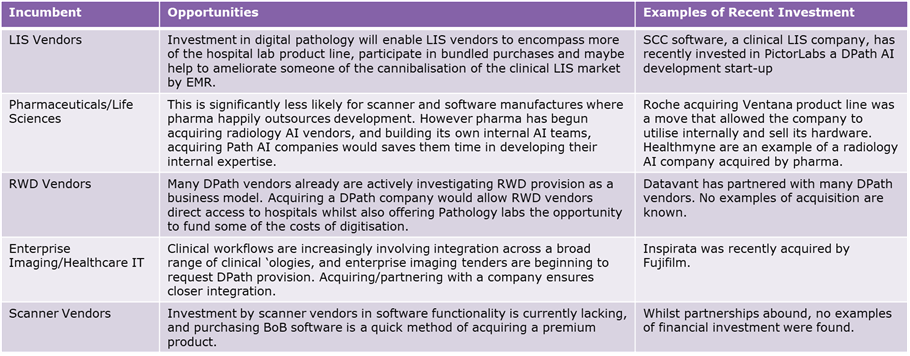

Our analysis of the market has shown that some vendors are clearly more likely to invest than others. The table below analyses some of the more likely beneficiaries of such acquisitions, as well as discussing rationale.

Table 1: Showing Prospective Vendors Able to Benefit from Digital Pathology Investment.

Table 1: Showing Prospective Vendors Able to Benefit from Digital Pathology Investment.

In recent years, investment from vendors has come most prominently from enterprise imaging providers. This demand is driven through the specification of digital pathology provision in Western European and US enterprise imaging tenders. Increasingly, those without a plan for digital pathology are being outcompeted.

However, the push is not so great for other types of vendor. This isn’t to say there isn’t potential for great gains for these companies, but instead it reveals that a wait-and-see approach is preferred. Many have been eyeing the market for some time and have likely noted historical growth has lagged projections. Recent regulatory movements, however, should offer the strongest indication yet that digital pathology is about to ‘tip’ clinically. This may be the signal vendors need to make a move.

Prospective Partners

It’s not easy to choose a potential partner however. Each type of vendor comes with its own risks and benefits, possessing strengths that may compliment unique companies. Table 2 below, provides a top-level overview of some of the types of vendors in the market today, as well as their prospective strengths and weaknesses.

*BoB = “Best of Breed”

*BoB = “Best of Breed”

Table 2: Evaluating the benefits and risks associated with purchase/investment in different digital pathology vendor types.

As is detailed, scanner acquisition offers the least risk and most short-term benefits for growth in the market today, but software is drawing increasing attention from several parties as interest from labs begins to steer towards more sophisticated technologies. And whilst AI digital pathology companies are less likely to be acquired in the near-term, smaller vendors are likely targets for larger software/AI vendors with better funding.

Overall, each product type can offer its own value and merits depending on the vendor, with approaches being discussed in further detail our upcoming ‘Digital Pathology – World – 2023’ market intelligence service. For more details please click here.

Into the Looking Glass

Fujifilm’s acquisition of Inspirata is not the last acquisition we’ll see, and further activity is expected in the next year. Additionally, Signify Research projects multiple new entrants to the market from both start-ups and larger healthcare IT vendors, with a few big names circling but yet to announce anything substantial.

To summarise; the digital pathology market today is rife with potential. Potential for investment and returns, potential for major shifts in competitive dynamics, and as is the ultimate goal: potential for vendors to have a real impact on the way pathologists work.

To learn more about Global Engage’s Digital Pathology and AI Congress: Europe please click here.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

SOURCE: Signify Research